|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding a $280,000 Mortgage: Key Insights for Informed DecisionsIntroduction to Mortgage BasicsSecuring a mortgage is a significant financial decision, and understanding the fundamentals is crucial. A $280,000 mortgage could be the gateway to owning your dream home or a valuable investment property. Factors Influencing Mortgage TermsInterest RatesInterest rates play a pivotal role in determining your monthly payments and the overall cost of your loan. They vary based on market conditions, your credit score, and the loan type you choose. To explore current options, consider looking at 10 year mortgage rates california for a snapshot of available rates. Loan DurationCommon mortgage durations include 15, 20, and 30 years. A shorter term usually means higher monthly payments but less interest over the life of the loan. Calculating Monthly PaymentsUnderstanding how to calculate your monthly payments helps in budgeting and planning. A typical formula includes the loan amount, interest rate, and loan term.

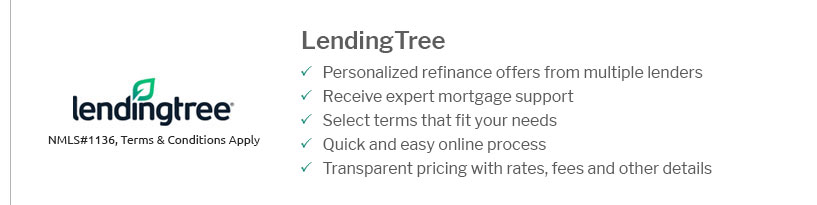

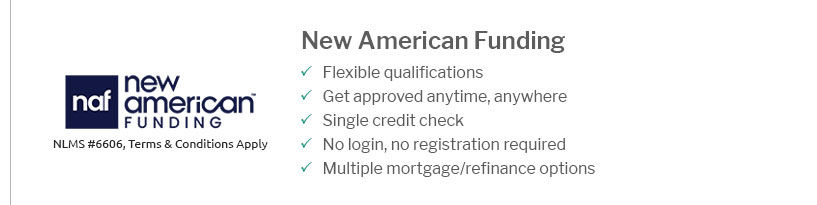

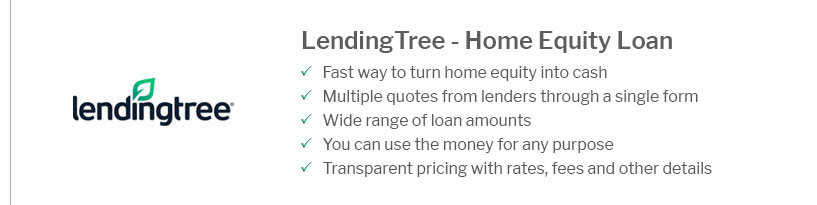

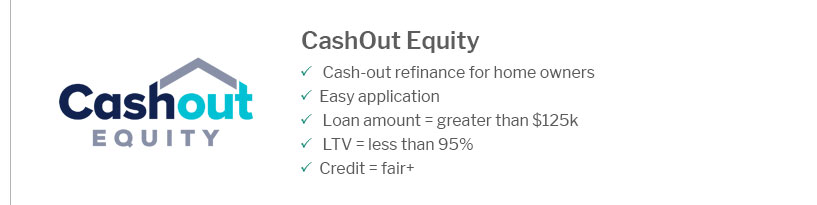

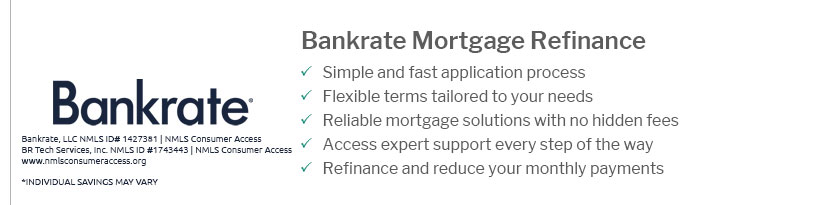

Exploring Refinance OptionsRefinancing your mortgage can be a smart move if interest rates drop or your financial situation improves. Check out refi rates 20 year fixed for competitive refinance options. Frequently Asked QuestionsWhat credit score is needed for a $280,000 mortgage?A credit score of 620 or higher is typically required for conventional loans, though higher scores can secure better rates. How much income do I need to qualify?Lenders generally prefer a debt-to-income ratio of 43% or less, which includes all your monthly debt payments divided by your gross monthly income. What are the benefits of a fixed-rate mortgage?A fixed-rate mortgage offers predictable monthly payments and protection against rising interest rates. Can I pay off my mortgage early?Yes, paying off your mortgage early can save on interest, but check for any prepayment penalties in your loan agreement. https://www.romeconomics.com/calculator/mortgage/280000

What's a typical down payment on a $280,000 Home? A down payment of 20% is standard for a 30 year mortgage but it can vary based on the lender. See the chart ... https://www.saving.org/loan/loan.php?loan=280,000

* Points are equal to 1% of the loan amount and lower ...

|

|---|